- Personal

- Business

- Private Client

-

About Us

- About

Follow these ATM security tips.

Follow these tips to protect your account information.

- Do not share your ATM card

- Save your ATM receipts

- Notify us immediately if you lose your card

- Branches

-

Branch Locations

Explore our 35+ branch locations throughout New York, New Jersey, and South Florida. -

New York Branches

Find your nearest Popular Bank branch location in New York. -

New Jersey Branches

Visit us in-person at one of our branch locations in New Jersey. -

South Florida Branches

Browse our Popular Bank branch locations in South Florida.

Withdraw cash when you need it.Enjoy access to Popular Bank ATMs and the Allpoint® ATM network.

- 55,000+ ATMs worldwide

- No sign-up fees

- Use your Popular Bank Mastercard® Debit Card

-

Branch Locations

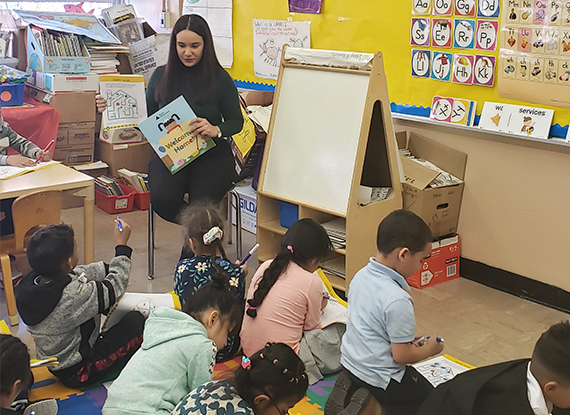

- Community

Get personal financing to help meet your goals.

Take more control of your finances with our personal loans.

- Discover your best rates

- Compare our benefits

- About

- Branches & ATMs

- Other Regions

United States

United States